Reputation of companies listed on Nasdaq Helsinki on the decline – KONE, Ponsse and Gofore are the most reputable

The family-owned companies listed on Nasdaq Helsinki top the list of the most reputable companies on the exchange, receiving higher reputation ratings from retail investors than other listed companies, according to a research by Reputation and Trust Analytics.

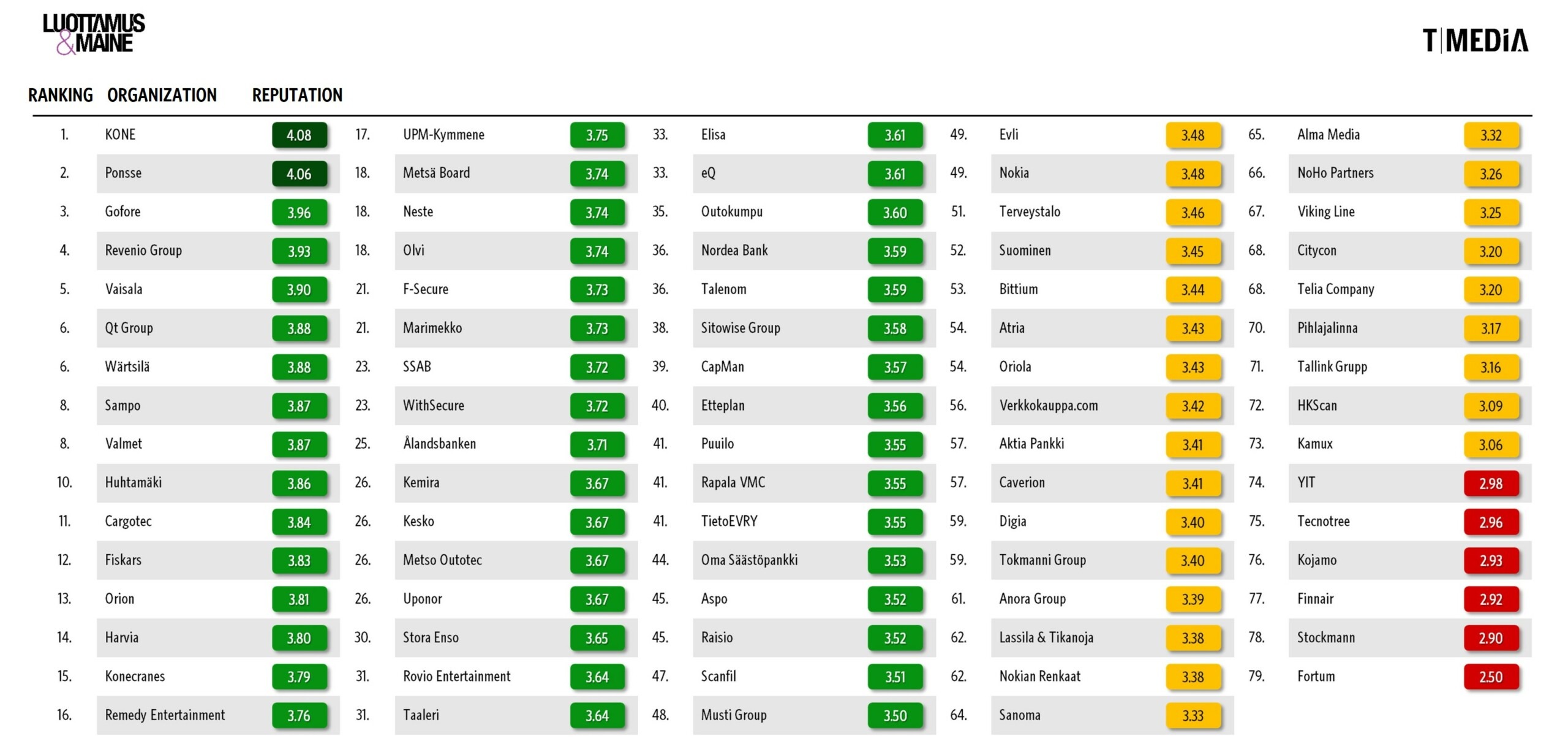

Reputation and Trust Analytics surveyed retail investors’ views on the reputation of 79 of Nasdaq Helsinki’s largest listed companies: KONE, Ponsse and Gofore were rated as the most reputable companies. KONE and Ponsse ranked first and second respectively last year. Gofore, which was ranked third, has moved up seven places since last year.

Reputation&Trust 2023: An organisation’s ranking is based on the reputation score obtained in the research. Reputation scores range from 1 to 5.

“Listed family-owned companies performed well in the retail investors’ reputation ratings. It is said that the quartile for a family business is 25 years. This is what retail investors like – stability creates trust,” says Sari Lounasmeri, CEO of the Finnish Foundation for Share Promotion.

“The reputation of the family-owned elevator company KONE is so solid that even the difficult business environment has not affected its reputation rating. Another family-owned company, Ponsse, received the highest ESG score in the study. Gofore, which was listed in the top three in 2017, also has a strong founder holding.”

Fortum’s reputation suffered the biggest fall of the year – Nokian Tyres’ reputation experienced the biggest rise

The results of Reputation and Trust Analytics research show that the reputation of companies listed on Nasdaq Helsinki is good on average, but has fallen for the second year in a row. The average reputation score for listed companies is 3.53 this year, 3.56 last year and 3.60 the year before.

The largest single decline in this year’s reputation research (-0.82) was recorded by the state-owned company Fortum. The company’s reputation fell for the second year in a row and ended up at the bottom of the list with a score of 2.50. The retail investors’ perceptions of Fortum’s management fell particularly sharply.

Nokian Tyres, which suffered from the Russia-Ukraine war, regained the trust of investors. Nokian Tyres improved its reputation by 0.30 points compared to last year, reaching a reputation score of 3.38 this year. However, the company’s reputation still lags behind that of two years ago, when it was listed among the companies with a good reputation (score ≥ 3.50).

In general, retail investors’ perceptions of the financial situation of companies listed on Nasdaq Helsinki and the capability of their management has deteriorated the most.

“Changes in interest rate markets and inflation, as well as global crises from the pandemic to the Russia-Ukraine war, affect almost all companies, affecting market valuations and reputations especially in Finland. However, management has a big role to play in setting a new direction and vision,” says Harri Leinikka, CEO of Reputation and Trust Analytics, the company that conducted the survey.

“In contrast to other dimensions of reputation, the perception of listed companies’ responsibility has improved slightly. This is a great achievement as, at the same time, expectations and demands for responsibility have increased,” Leinikka continues.

About our research

The Reputation&Trust 2023 research of companies listed on Nasdaq Helsinki examined the reputation of 79 companies among Finnish retail investors. The companies’ reputations were measured using the Reputation&Trust research model, which assesses reputation based on eight factors: Governance, Financial Performance, Leadership, Innovations, Dialogue, Products & Services, Workplace and Responsibility.

The target population of the survey was Finnish retail investors aged 15 and over, nationwide. The survey data was collected via an electronic questionnaire from 11 May to 26 June 2023 in cooperation with the Suomen Osakesäästäjät and the Finnish Foundation for Share Promotion.

A total of 7,757 individual retailprivate investors participated in the survey, providing a total of 18,837 company valuations. The statistical margin of error for the entire data set is at most about approximately 1.11 percentage points at most. For individual companies, the margin of error for the reputation score is between 0.04 and 0.06 units, depending on the standard deviation of the validated company-specific estimates.